Bitcoin Tactical timeframe

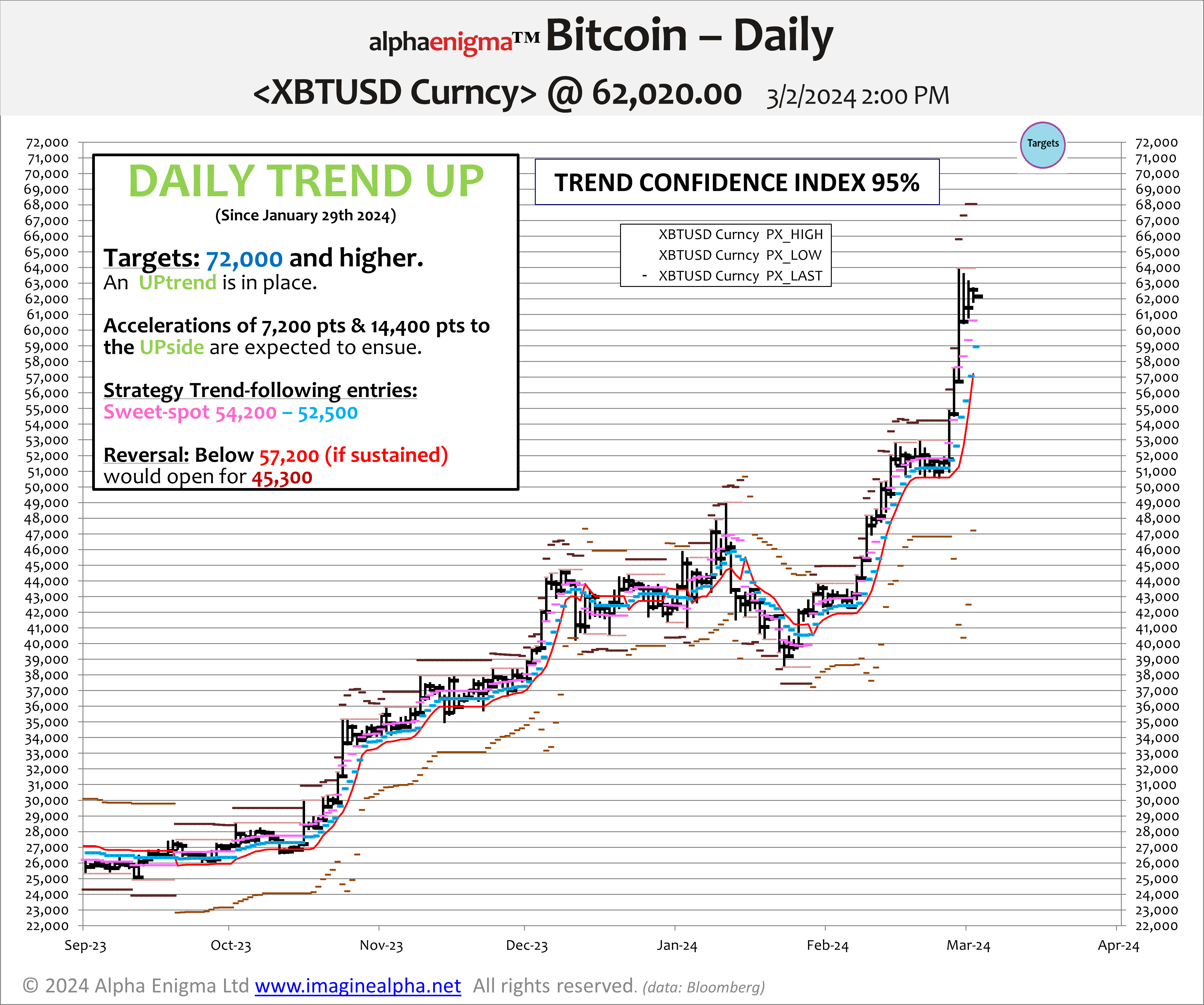

The call on March 2nd of a rally up to 72,000 and possibly 77,000 in a repeat of 2021 before a retracement into the 50,000s has materialized.

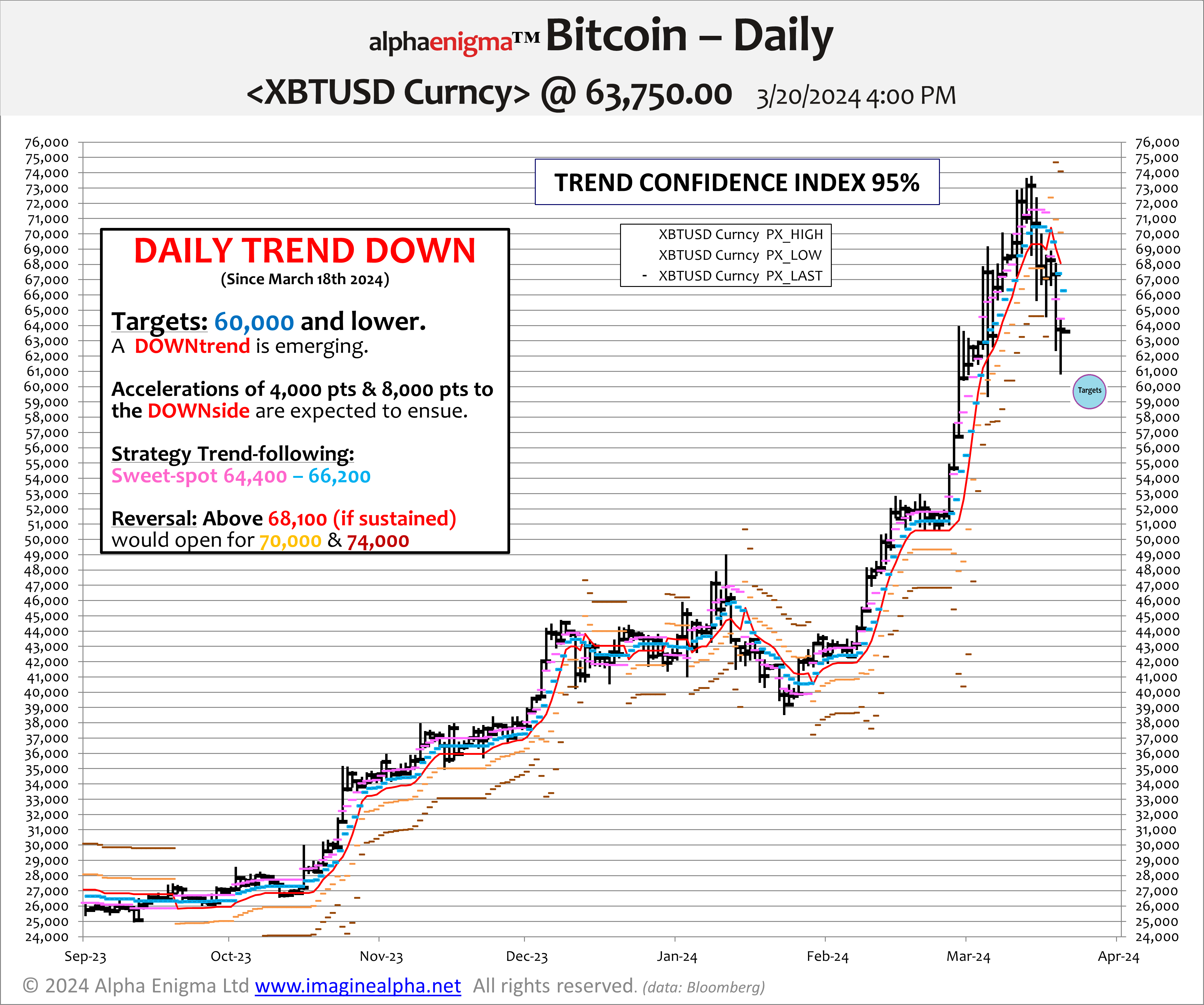

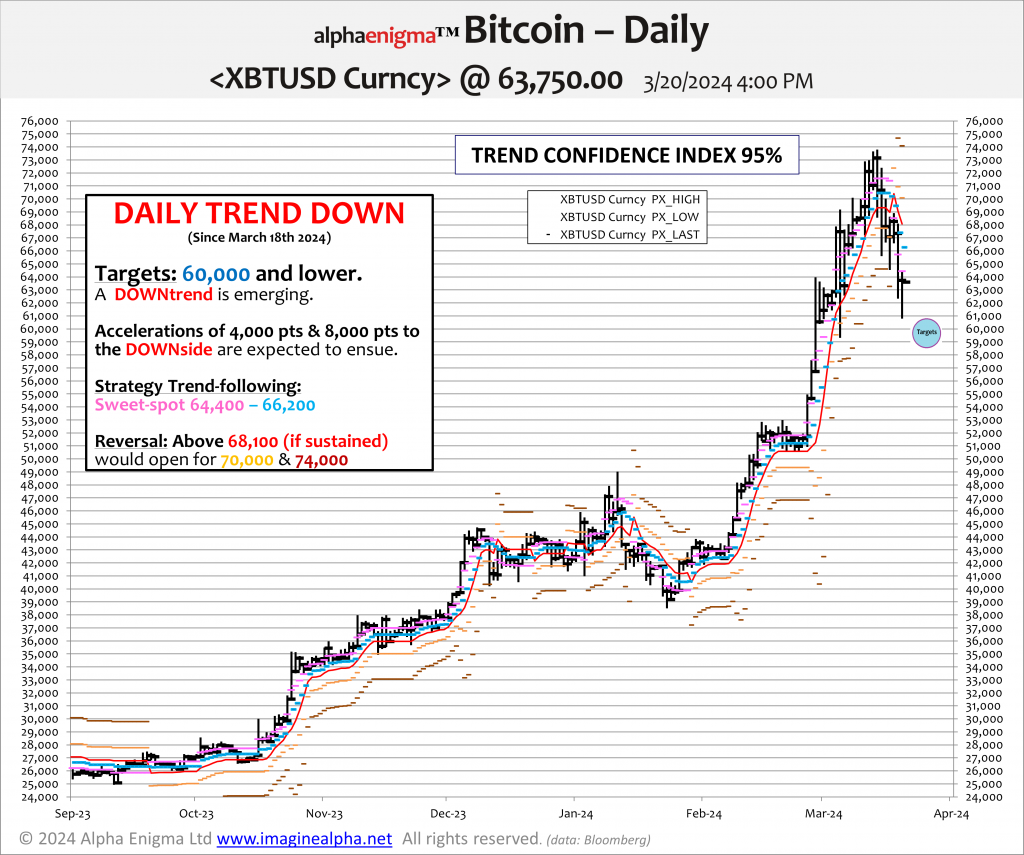

The reversal on March 18th has targets at 60,000 for the immediate future ahead of the larger and more symbolic level at 58,000 where the Strategic UPTrend has its support level.

Therefore the price action in the near term can be portrayed as a converging wedge between 68,000 and 58,000. Selling should appear on bounces toward 64,000/66,000 the sweet-spot of the Tactical DOWNtrend whilst 60,000 and 58,000 will offer an opportunity for Bitcoin bulls to add.

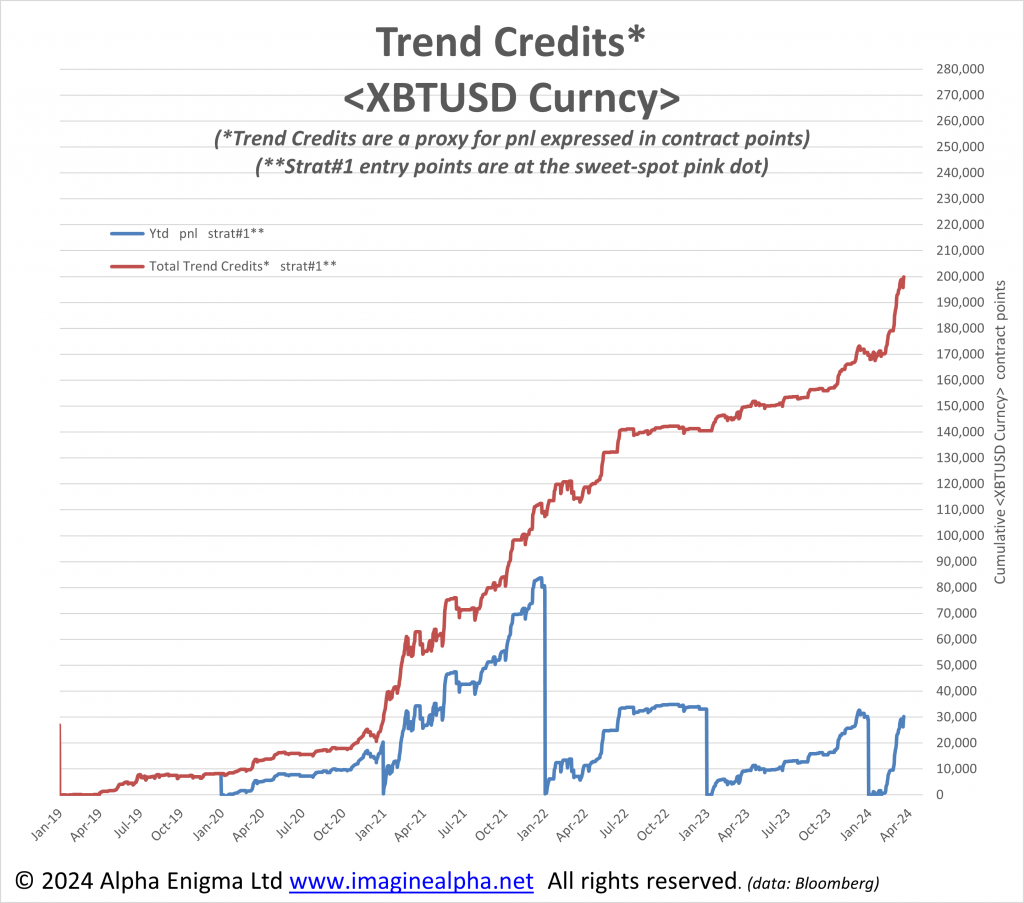

Tactical signals have been “equity accretive” since 2019

The graph below shows the propensity of XBT to trend, both UP and DOWN. The exhibit below is not a firm back testing exercise, hence the use of the term Trend Credits to account for the accumulated amount of contracts points over the entire lookback window. Nevertheless, following trends around the sweet-spot (pink dot) would enable to limit drawdowns and increase the risk/reward profile.

So far in 2024 XBT has produced 30,000 Trend Credits* matching the tally of 2023 and approaching that of 2022. This could be the moment when the trend takes a breather. If so the range will narrow above 58,000 and below 68,000 for a few more weeks.

The alternative is more aggressive in terms of price movements:

a) 68,000 is taken out anew in which case 78,000/80,000 would be next or

b) 58,000 is not strong enough to stop the liquidation of the recent length opening up for 49,000 and 33,000.

For the moment the Bears have the upper hand.

Soon we will have some news about ImagineAlpha. So stay tuned!

For further details please drop me an email at carlos@imaginealpha-blog.com