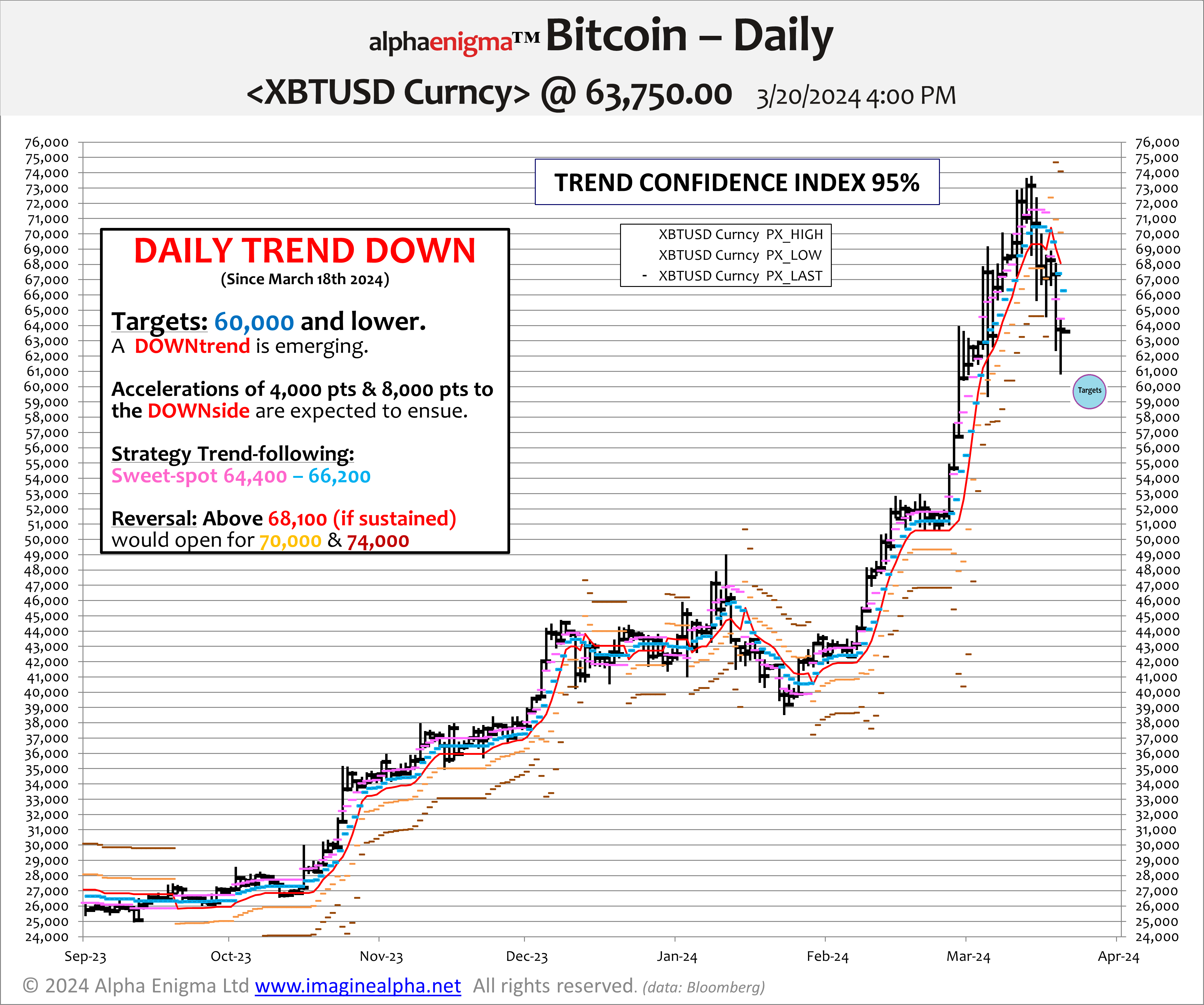

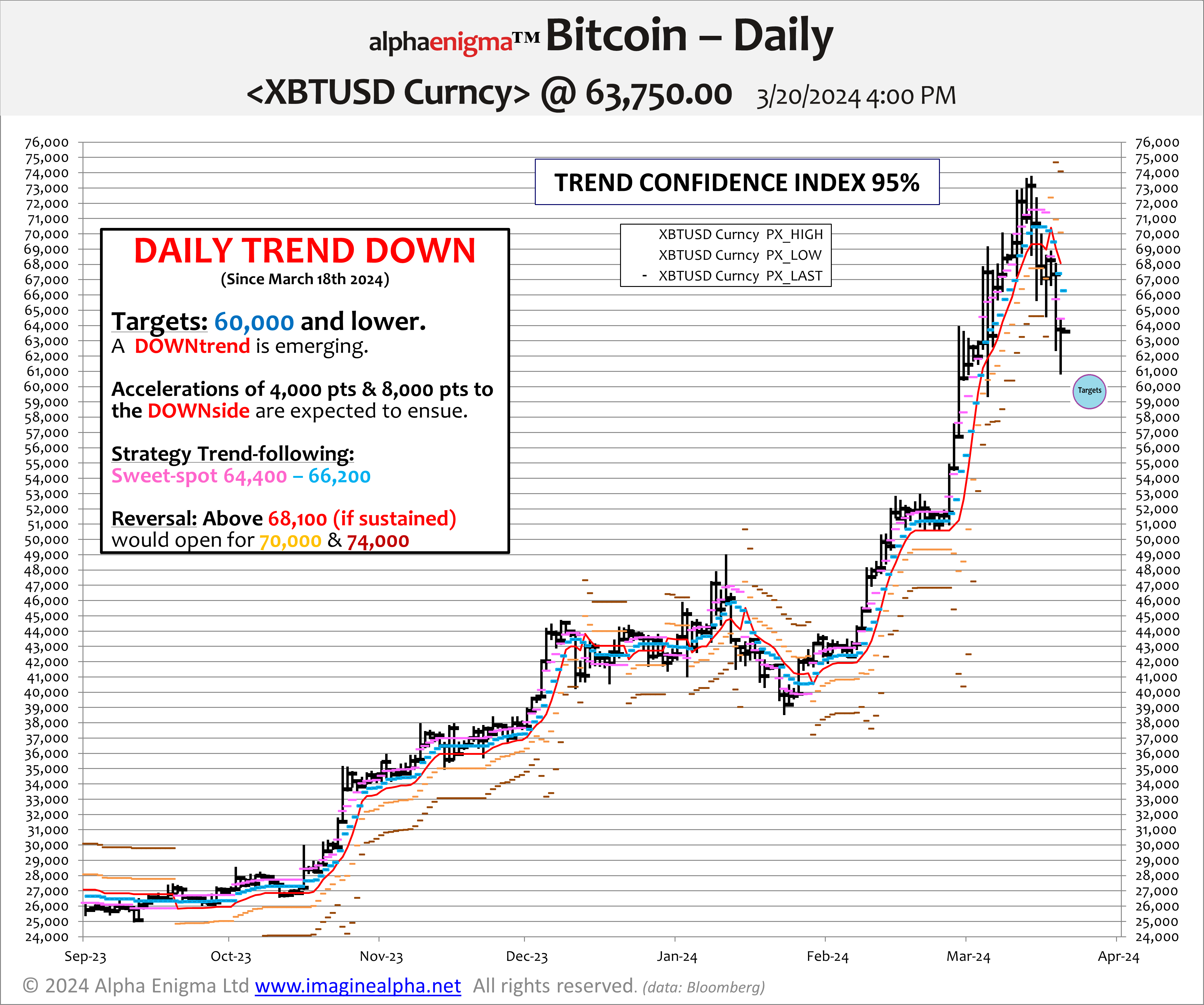

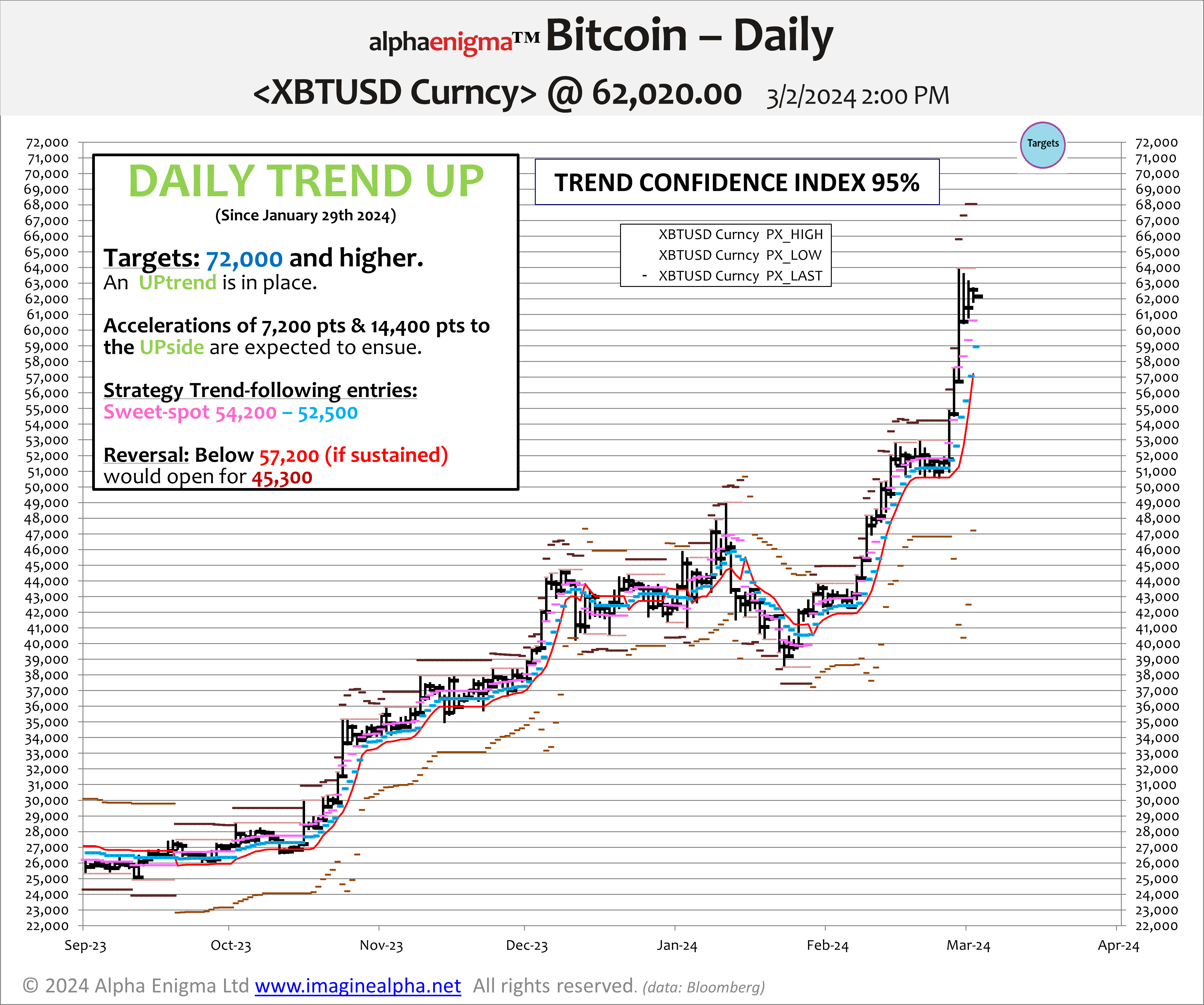

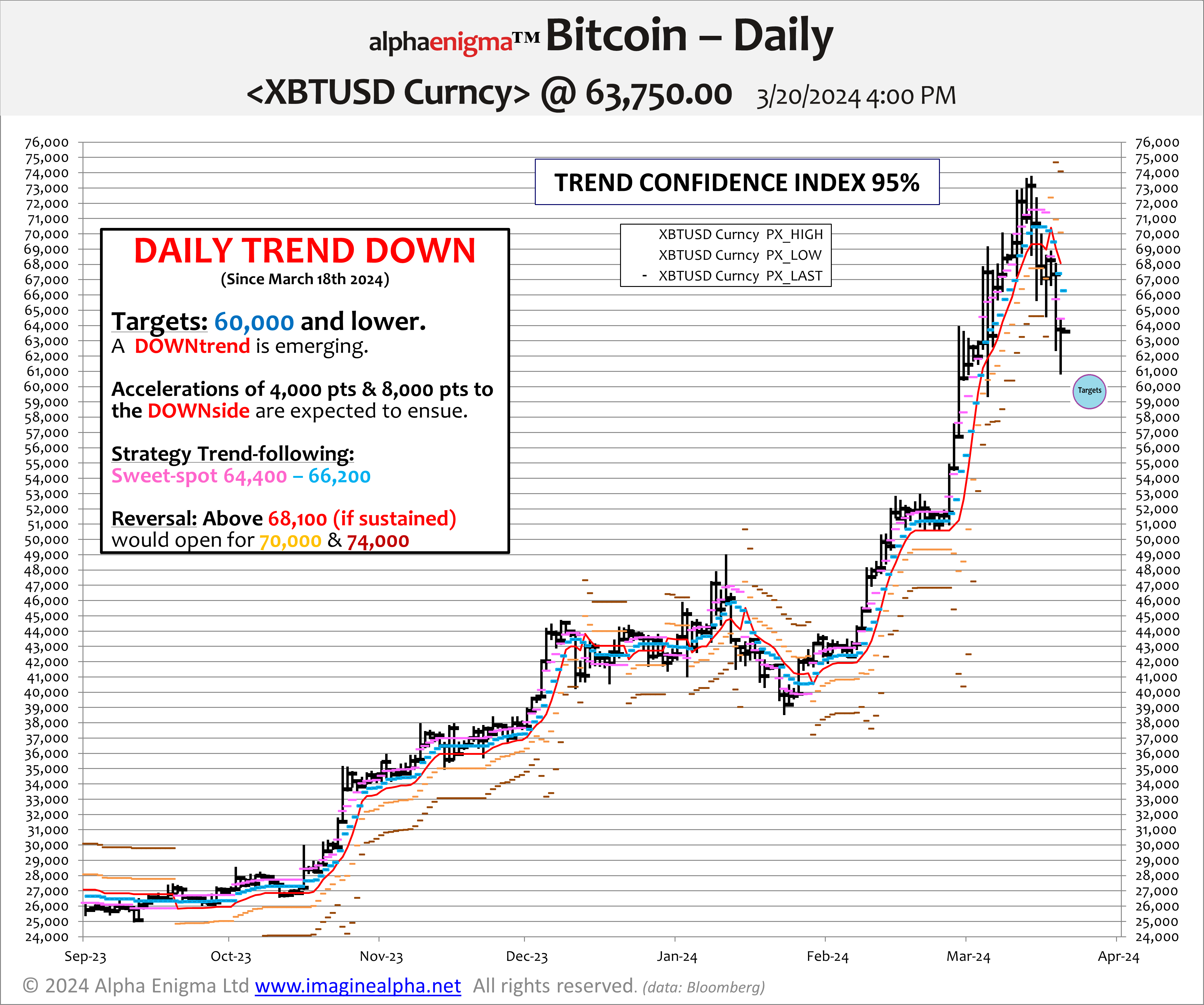

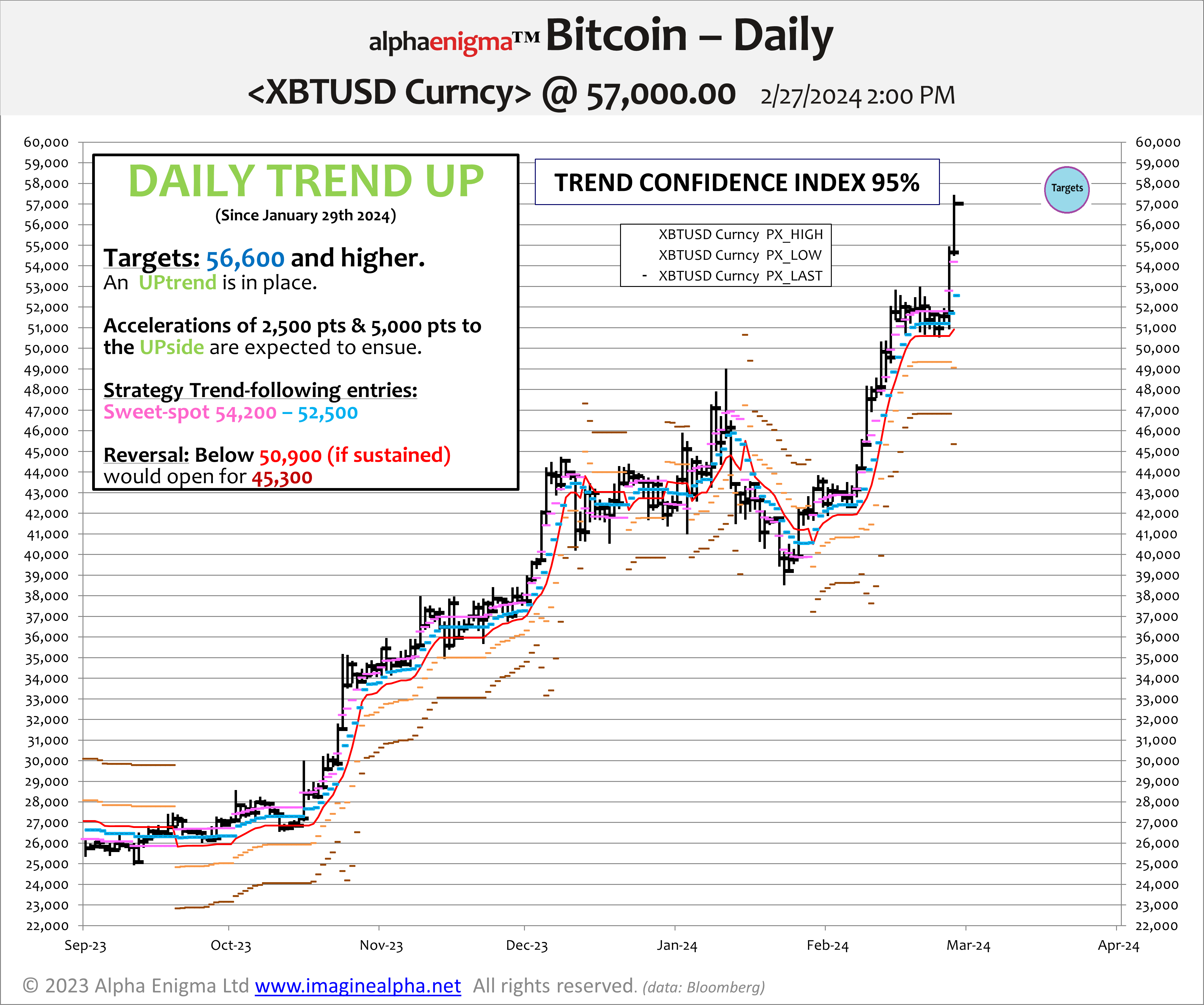

Bitcoin Tactical timeframe The call on March 2nd of a rally up to 72,000 and possibly 77,000 in a repeat of 2021 before a retracement into the 50,000s has materialized....

Bitcoin Tactical timeframe The call on March 2nd of a rally up to 72,000 and possibly 77,000 in a repeat of 2021 before a retracement into the 50,000s has materialized....

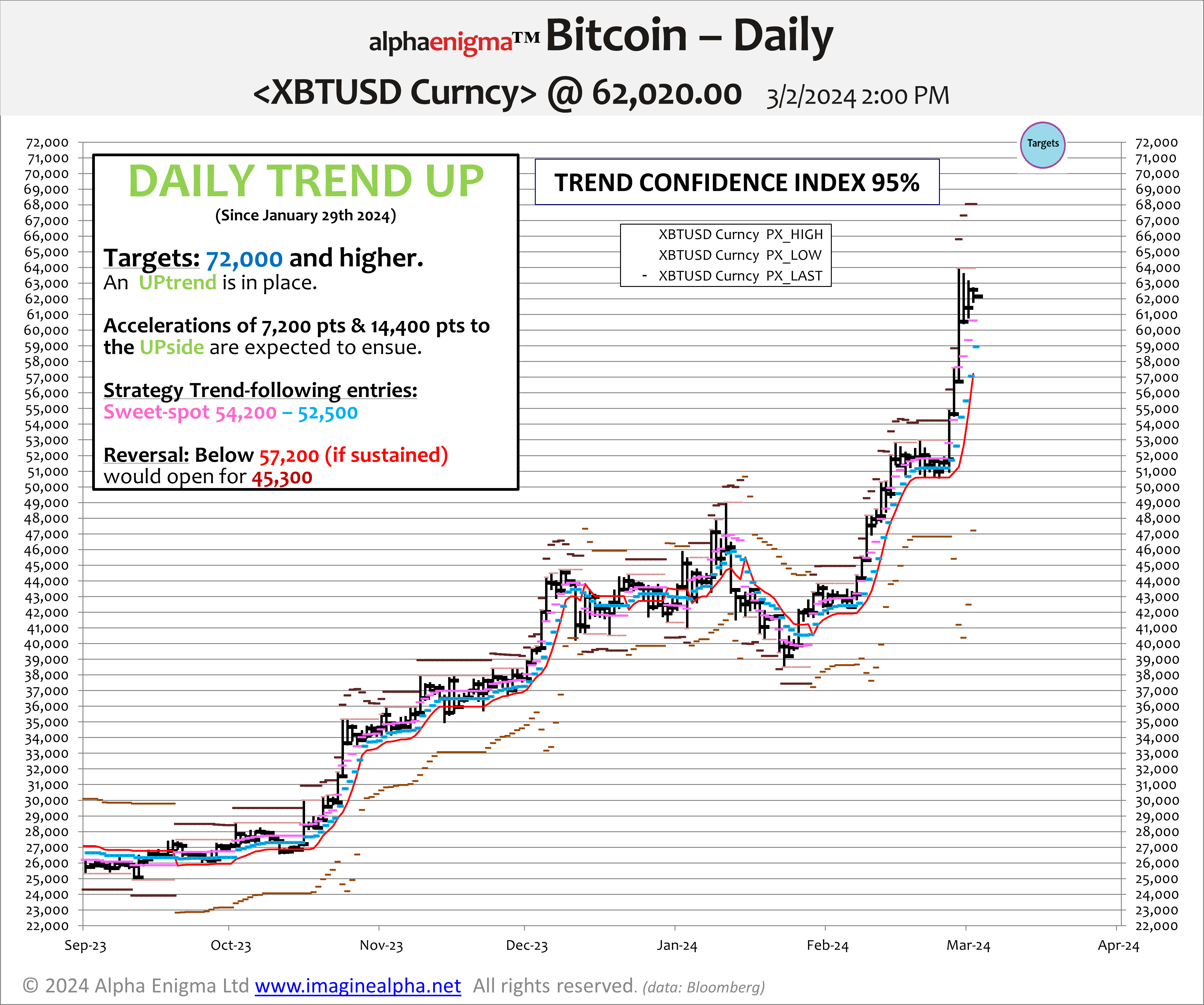

Reminiscences of 2021...Peak 68K is within a stone throw after a week of explosive accelerations...

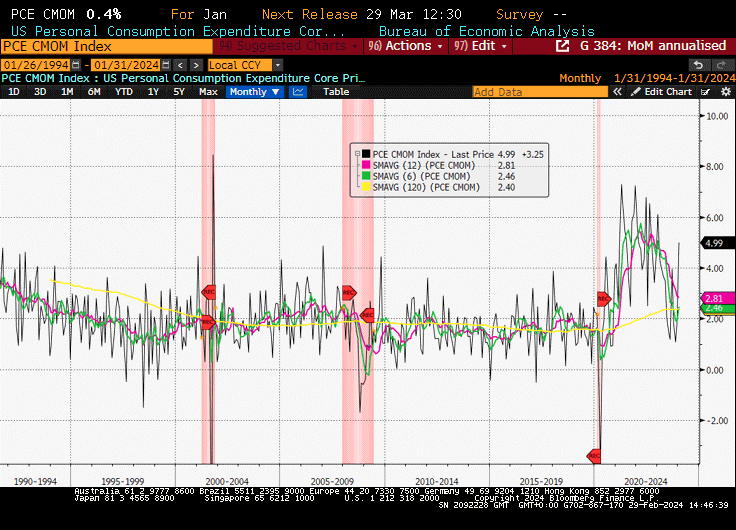

Only six trend inflections over the past 12 months...The SP500 remains unsensitized to the latest "sticky" inflation report.

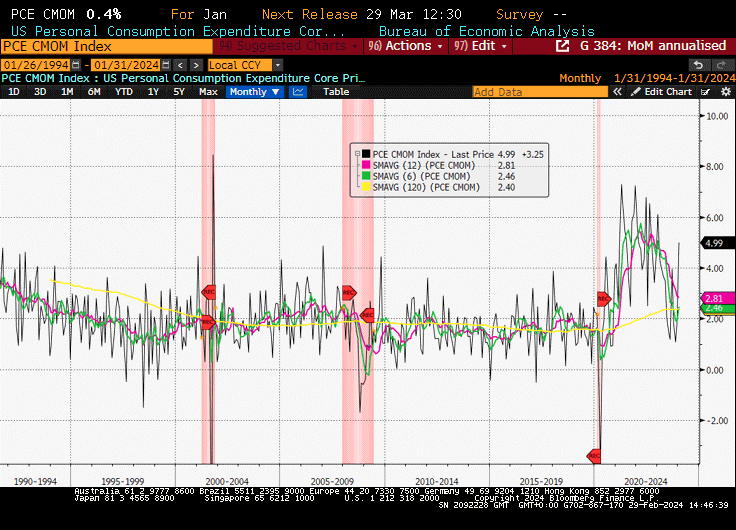

US PCE inflation report for January confirms the "sticky" tone from the CPI.

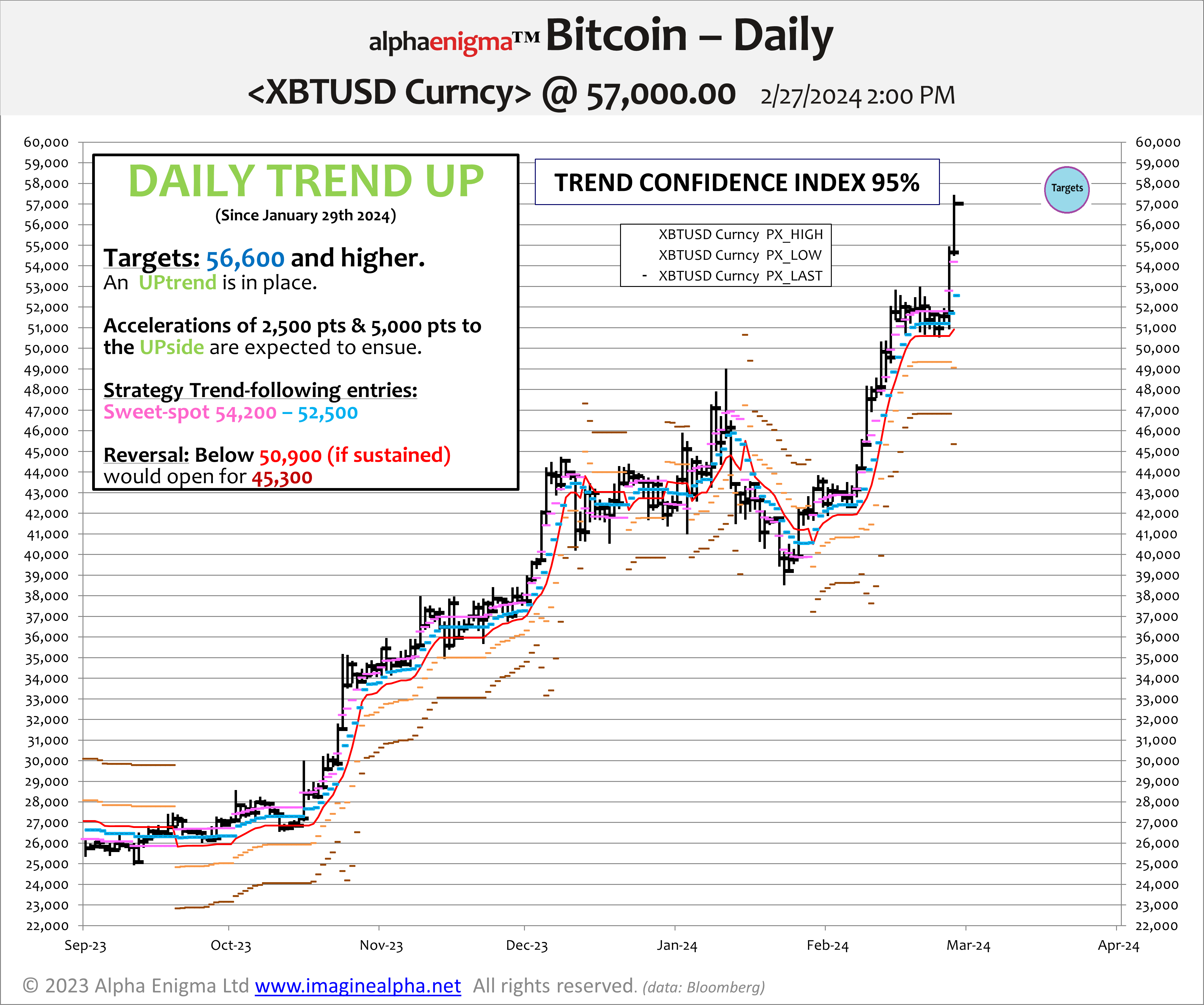

A return to the volatility experienced in 2021 seems to be in train, the consequence of which could spark a spike to 61,000 & 70,000 over time.

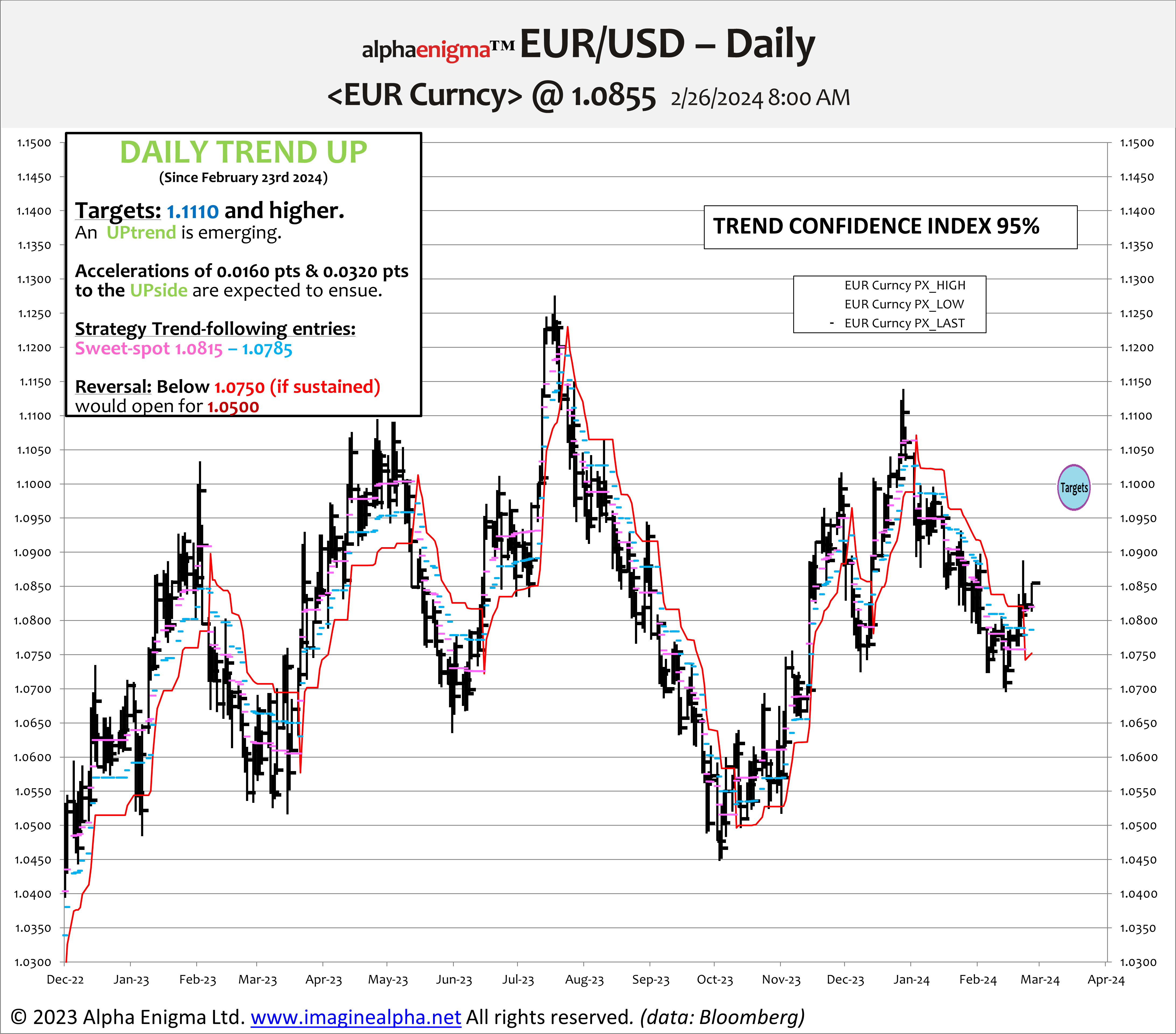

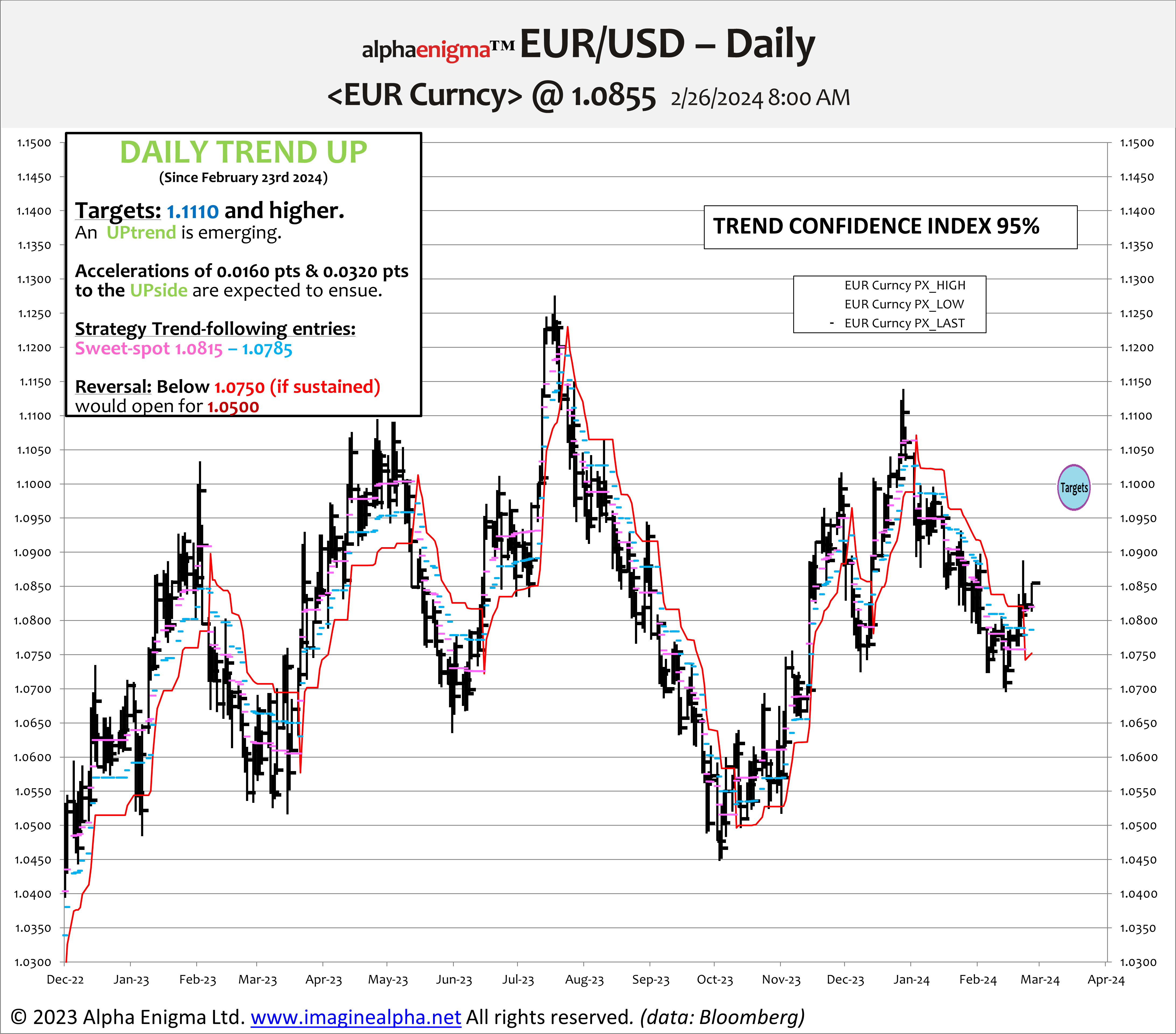

Expectations around the ECB cutting rates first are trimmed, supporting the rise of EUR/USD. For more go to www.ImagineAlpha.net

Carlos Daurignac (Strategist London-New York-Paris) has created ImagineAlpha’s innovative process to help traders, hedgers and investors identify signals and build alpha generating strategies as well as harnessing key aspects of risk management on global markets.

Carlos offers easy to use visual-based output for his proprietary models enabling fast and efficient interpretation of trends in global markets and of macro-economic fundamentals.

For more than 25 years, he has brought profitable advisory solutions in FX/Rates/Global Macro to numerous trading/investing environments, among which hedge funds with more than $30 bn of AUM at the time such as Brevan Howard Asset Management and H2O Asset Management following a career on the sell-side at Indosuez – Standard Chartered and SocGen.

carlos@imaginealpha-blog.com

Bitcoin Tactical timeframe The call on March 2nd of a rally up to 72,000 and possibly 77,000 in a repeat of 2021 before a retracement into the 50,000s has materialized....

Reminiscences of 2021...Peak 68K is within a stone throw after a week of explosive accelerations...

Only six trend inflections over the past 12 months...The SP500 remains unsensitized to the latest "sticky" inflation report.

US PCE inflation report for January confirms the "sticky" tone from the CPI.

A return to the volatility experienced in 2021 seems to be in train, the consequence of which could spark a spike to 61,000 & 70,000 over time.

Expectations around the ECB cutting rates first are trimmed, supporting the rise of EUR/USD. For more go to www.ImagineAlpha.net