Bitcoin Tactical timeframe (an update)

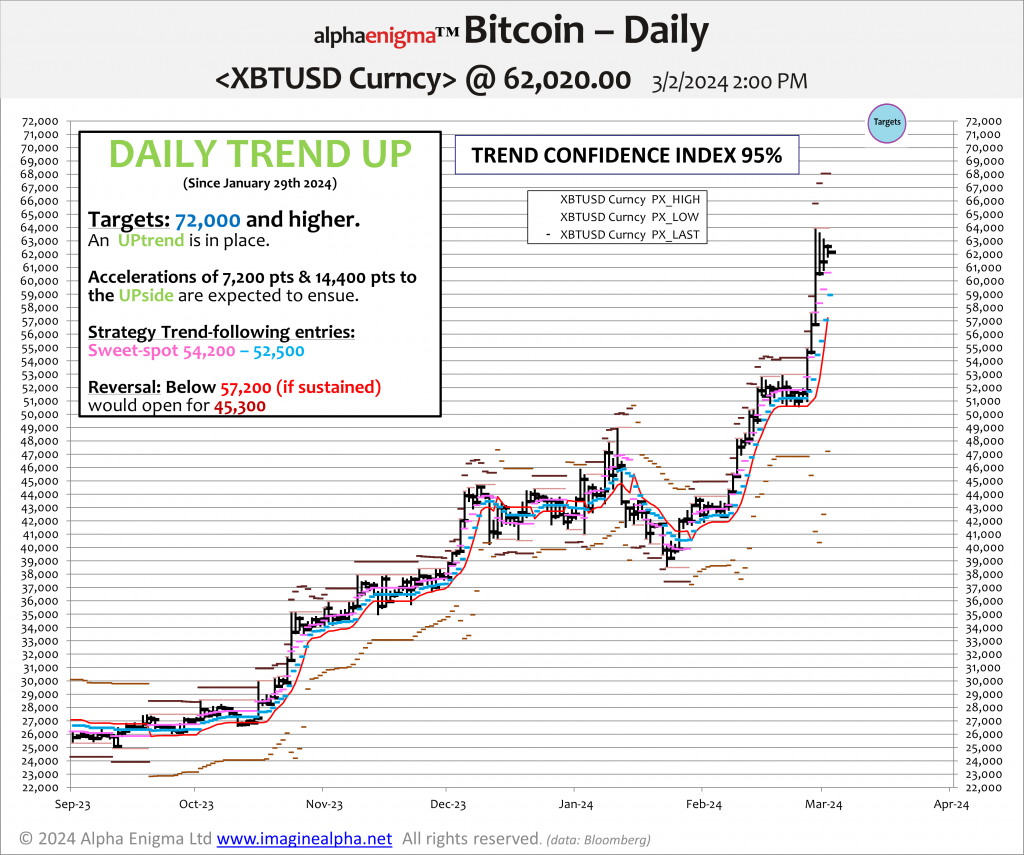

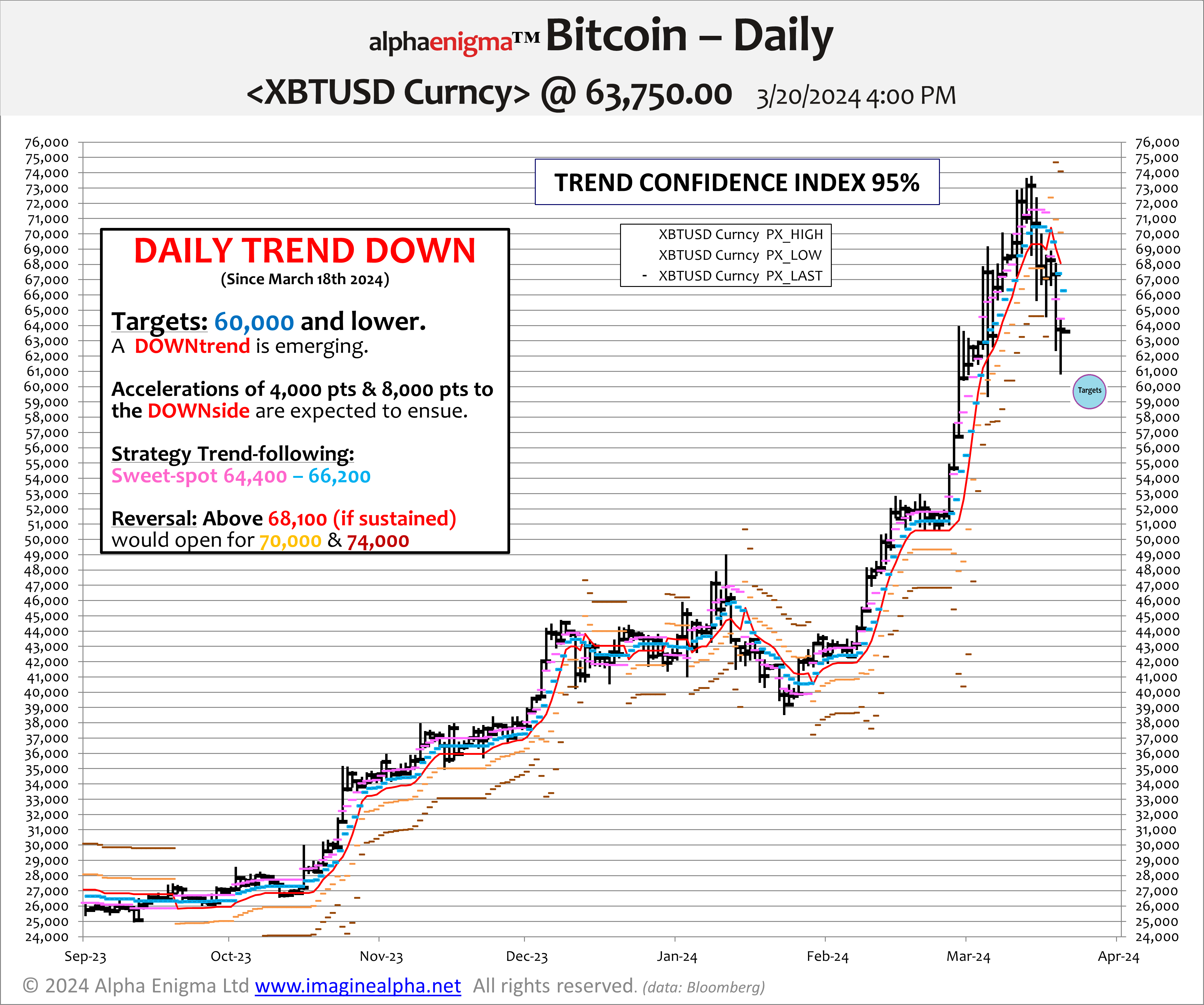

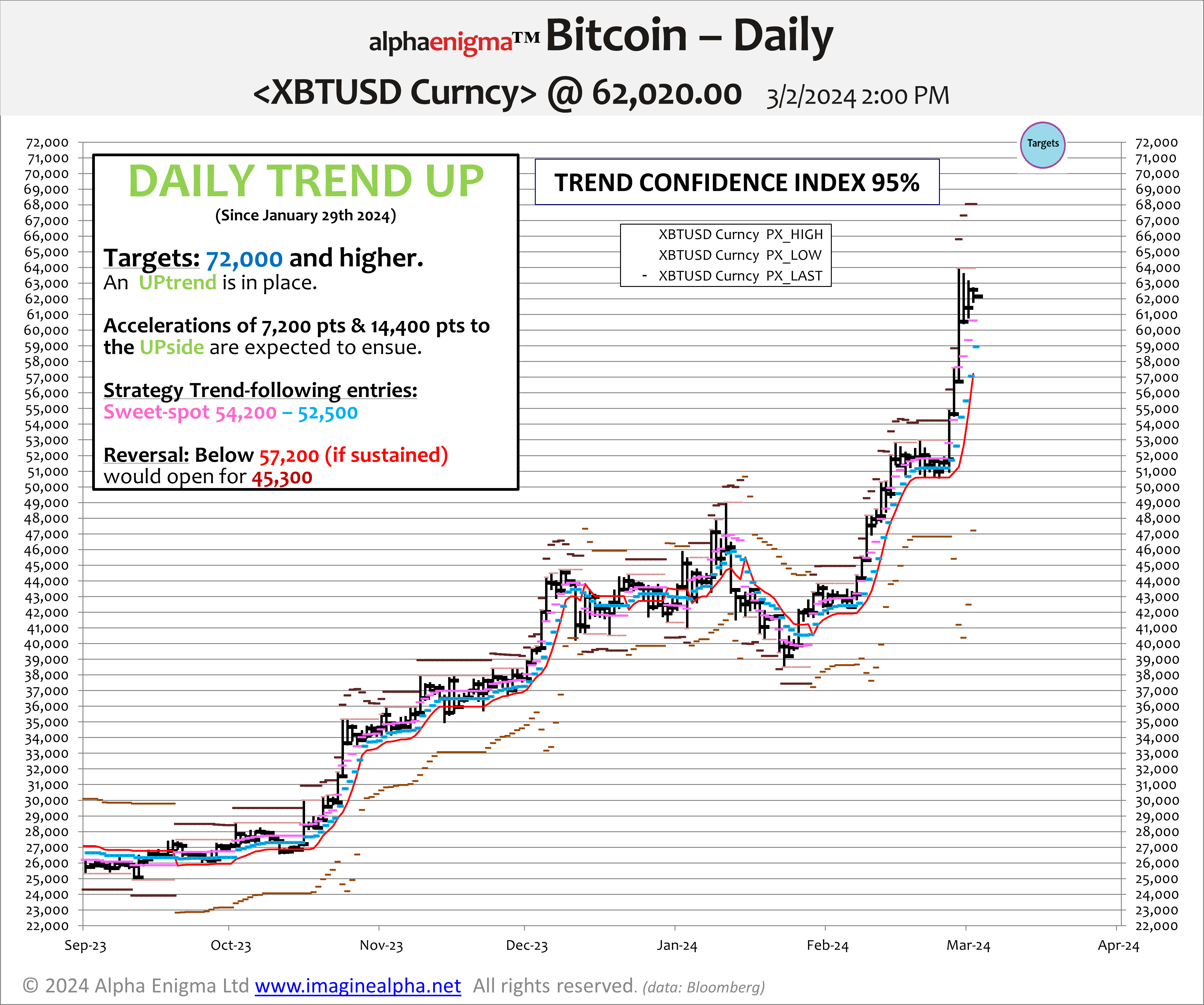

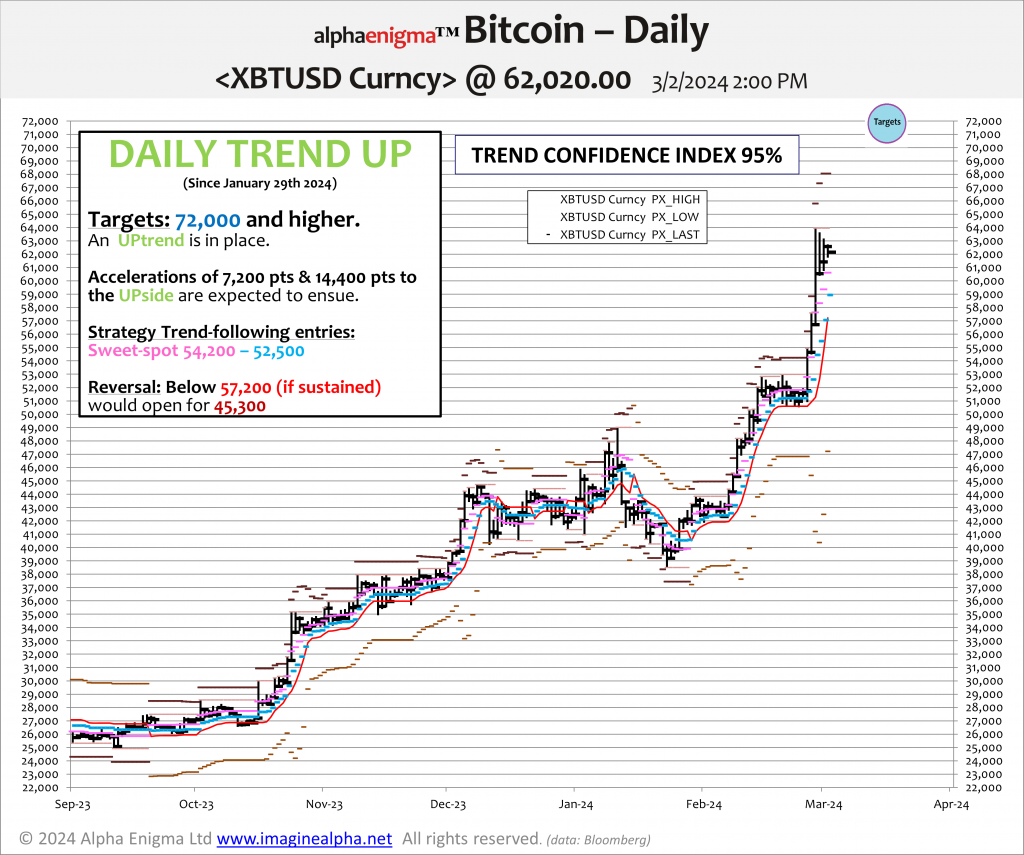

Echoes of 2021 are coming fast and furious. First the summit of Mount Bitcoin – “Peak 68K” – reached in 2021 is within striking distance. Based on today’s market enthusiasm the near-term target (5/20 day horizon) is raised from 61,000, achieved this week, to 72,000.

In the Strategic timeframe (3/12 months) that we use in our “Double Alpha” set-ups for an even much better track record, the targets zone for the upcoming acceleration is in the vicinity of 77,000.

As you now understand from ImagineAlpha’s process, all this is conditioned on Bitcoin holding above 57,000 early into the new week and 60,000 thereafter. A repeat of 2021 would mean a peak in the 70,000s and a subsequent decline below 50,000.

In 2021 the hardening of monetary policy guidance went a long way to put a cap on the UP-trend. In 2024 the market is minimizing that threat. That makes all the difference.

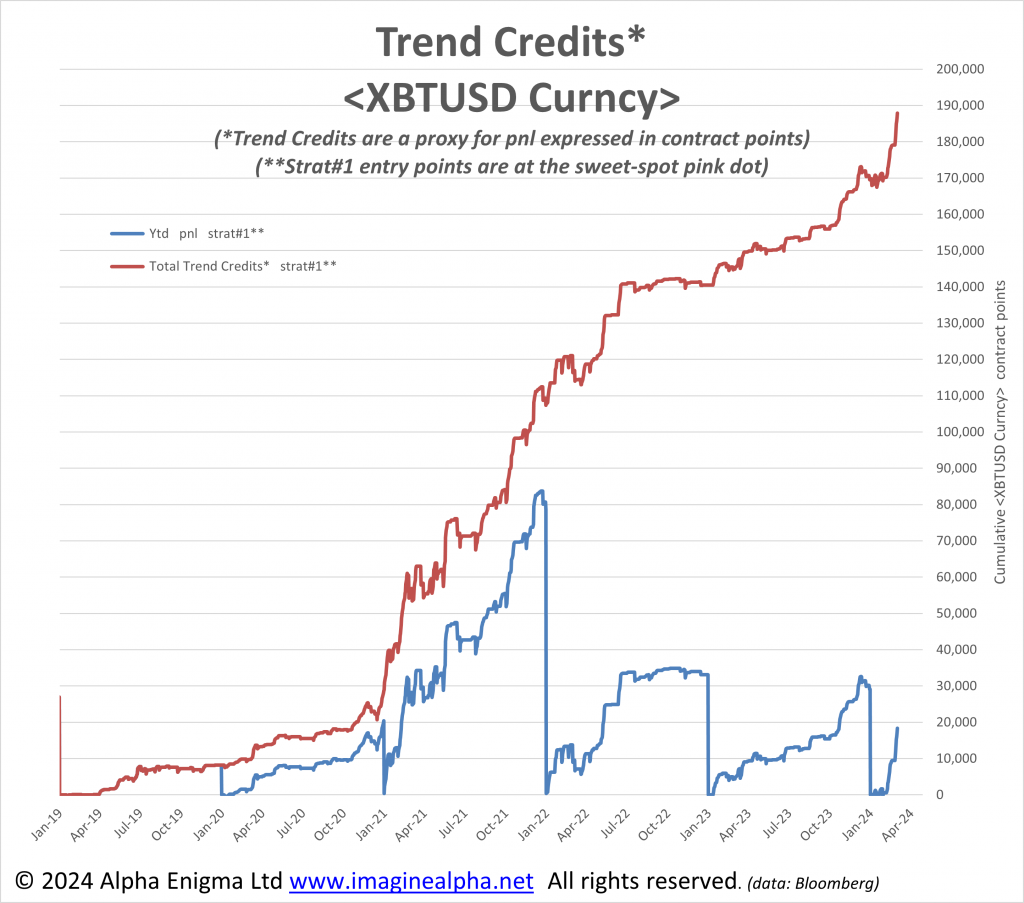

Tactical signals have been “equity accretive” since 2019

Based on current prices Bitcoin is on course to produce as many Trend Credits* as last year or more. Fueling its instability are investors’ appetite for that asset, reminiscent of 2021, which is increasing the potential for large price swings as well as the perception that monetary policy will be loosened rapidly and meaningfully even in a context of “sticky” services inflation.

ImagineAlpha will endeavour to catch that potential irrespective of the trend being UP or DOWN.

For further details please contact carlos@imaginealpha-blog.com